Practical insights

Current expected credit loss (CECL)

The financial crisis 2007-2008 highlighted the deficiencies of accounting standards that do not allow for timely adjustments of loss reserves but work on incurred losses only. Regulators across the globe have reacted to these deficiencies by introducing standards that replace the incurred loss approach by an expected loss approach. The US GAAP Allowance for Loans and Lease Losses (ALLL) has been replaced by ASU 2016-13 (CECL = current expected credit losses) and the IASB replaced the old standard IAS 39 with IFRS 9. In the new regulations the critical underlying idea is to account for losses on an expected rather than an incurred basis. They incorporate forward-looking information about credit losses, effectively accelerating the recognition of impairment losses (see figure 1).

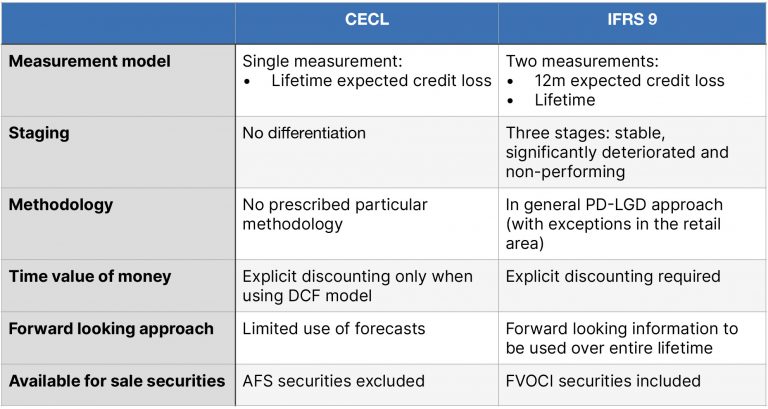

While the key underlying idea is the same for CECL and IFRS 9, it should be noticed that there are also key differences between the two, making a direct comparison even on the same portfolio a rather cumbersome task. The most striking difference probably is that the set of financial instruments to which the new standard has to be applied is significantly different (see table 1).

Nevertheless, it is undoubted that the introduction of this new standard is one of the biggest accounting changes in a decade and affects financial services institutions most. While most banks and also insurance companies that are large SEC filers have digested the standard already in 2020, there are still the segments of Other Public Business Entities (PBEs), smaller reporting companies (SRCs), mutual insurance companies and private companies that are due in 2023. It should be noted that the NAIC is currently considering CECL type changes to Statutory Accounting and if it accepts those changes in the future this could have material impact on regulatory capital.

New CECL model

The new standard requires entities to estimate and immediately recognize credit losses expected to occur over the contractual life of the financial asset. Most financial assets carried at amortised costs are subject to the new standard. In order to determine the expected credit losses the entity should base its estimate on current market conditions, reasonable and supportable forecasts and make use of all relevant and available information and past events. The estimate should be unbiased, which is in contrast to capital models that typically include a margin of conservatism.

The standard does not prescribe concrete methodology and some possible approaches are the following:

- Historical loss rates

- Vintage method

- Rating migration approach

- PD/LGD method

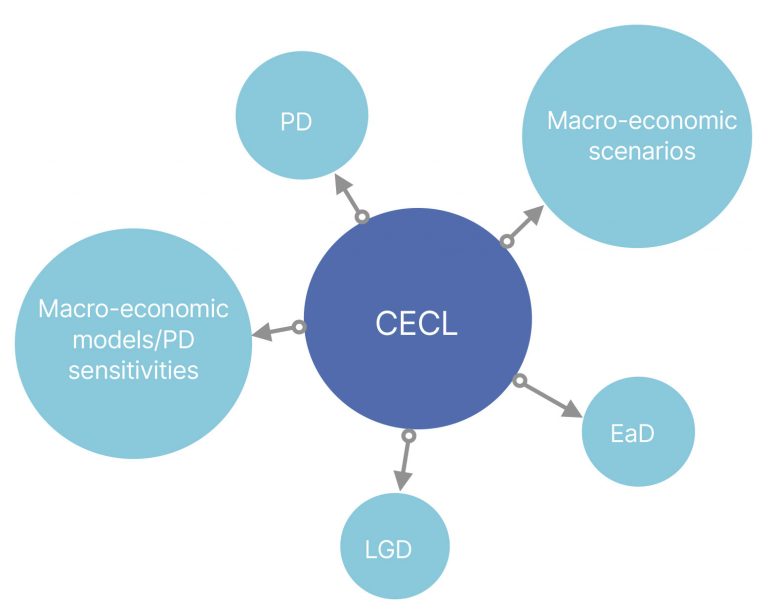

In the following we will focus on the PD-LGD method, where credit losses are calculated as the exposure at default (EaD) times the default probability (PD) and adjusted for the loss-given-default (LGD):

expected credit loss = EaD x PD x LGD

The PD-LGD approach can be considered industry standard for all large financial institutions, but also for smaller and medium-sized institutions this approach holds great advantages and can be the starting point of setting up a more developed quantitative credit risk management (see also SigmaQ’s document on setting up a quantitative credit risk management in insurance companies). The overall CECL setup with a PD-LGD approach is illustrated in figure 2.

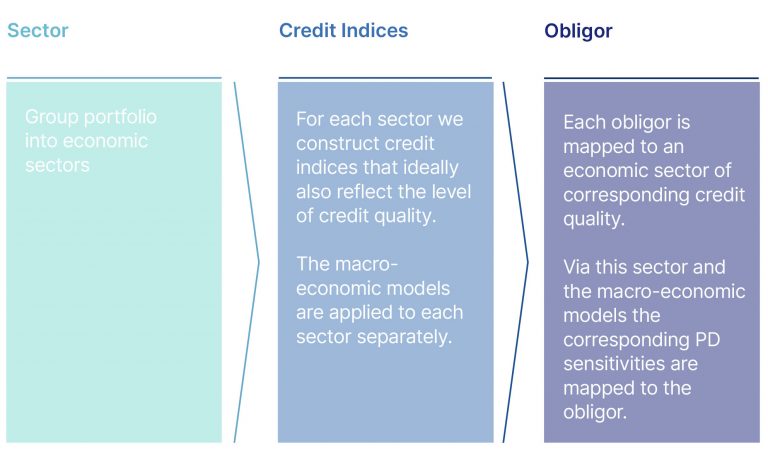

When measuring credit losses under CECL, entities should evaluate financial assets that share similar risk characteristics on a collective (pool) basis. These can for example be geography, credit ratings, financial asset type, size, and term. Assets based on any one or a combination of such joint risk characteristics can be aggregated for the purpose of the loss calculations (figure 3).

How we can help you

We have extensive knowledge in the quantitative credit risk area in general and have worked particularly on CECL/IFRS9 models over the recent years. We bring a wealth of experience in implementing expected credit loss models for banks and insurance companies.

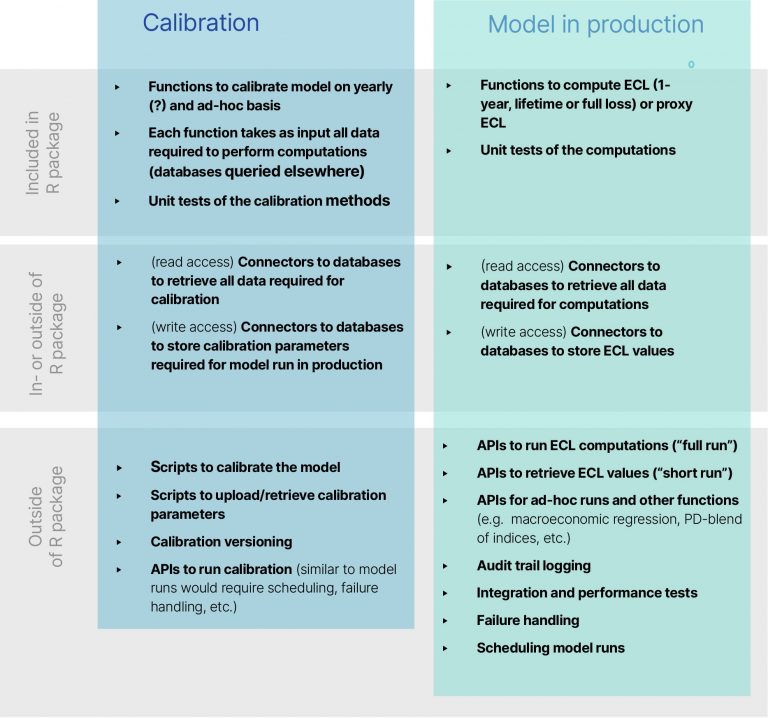

We take a pragmatical approach that is tailored to the individual client’s needs and the IT infrastructure and data setup. In figure 4 we show an example of a model architecture implemented for one of our clients. It disentangles day-to-day calculations from more infrequent calculations like the actual calibration of the model, thereby simplifying model and data complexity.

We do not only deliver on the implementation itself, but can also help you in catching up on the data side: SigmaQ provides corporate default probabilities for more than 35’000 corporates globally and LGDs for more than 100’000 debt issues. This universe is sufficient to cover most investment portfolios. Our data service can speed up your CECL implementation significantly. It can be seamlessly integrated into your infrastructure via our API service.