Data Service

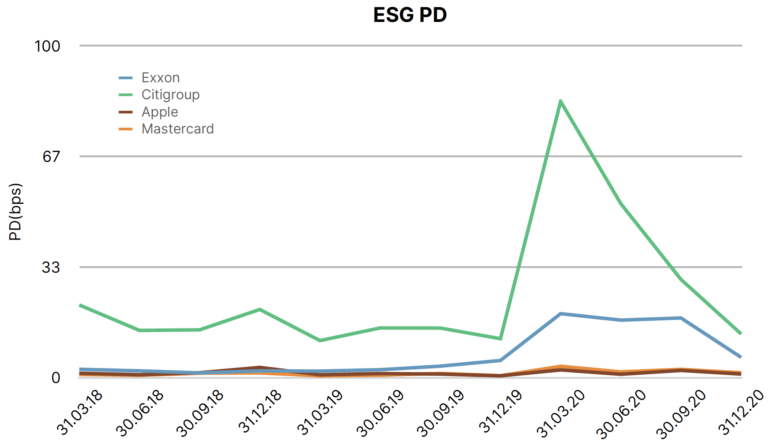

ESG PD-

let the data speak

SigmaQ Analytics is one the first vendors in the world to successfully integrate ESG factors into its PD models. We offer corporate PD with ESG factors for 8,000 companies worldwide. By comparing PD with and without ESG factors, analysts can observe the impact of adding ESG factors when selecting companies in their portfolio.

Most of the PD modelling methodologies were developed more than 20 years ago. They were not designed to capture rapid changes in the economic environment (structural breaks) or to introduce new factors, such as ESG factors, in their models. SigmaQ’s model was developed specifically with the aim of capturing rapid changes in the economic environment as well as to incorporate new factors in the model.

The traditional so-called structural approach maps distance-to-default (DD) to historically observed default rates. In this approach it is difficult to add ESG factors as data on ESG factors is limited to only three to five years. These models somehow tweak ESG factors into their PD estimation, which was not part of the original approach. Reduced-form models, which often use a logistic approach to generate PDs, have similar problems. Since the data on ESG factors is limited, the logistic regression models can only use three to five years of data if they want to introduce ESG variables in their regressions. This means that significant relevant historical information that would be useful for explaining the default process is lost.

SigmaQ’s methodology

Realizing the problems faced by the traditional approaches in adding new factors in modelling, SigmaQ Analytics has developed a breakthrough framework for estimating PDs. Our approach takes estimates based on historical data and then updates them based on new data as it becomes available. Hence, our approach itself is designed to incorporate the impact of rapidly changing economic conditions on historical estimates as well as for incorporating new variables such as ESG factors in the model. In doing so, our approach utilizes historical and recent data in estimating the model parameters. Such an updating process is not available to the traditional approaches discussed earlier.

Our PD model combines the latest developments in Data Science, Econometrics and Bayesian statistics to extend our corporate probability of default estimates with ESG factors. Our ESG PD model is not built using rating models and/or qualitative information, but is derived from ESG, financial and market data only. Our model is fully calibrated with ROCAUC scores above 93%. The ESG PD model builds on SigmaQ’s PD model that covers more than 35,000 companies worldwide and was launched in 2021.

The data

Our ESG data cover close to 50 ESG metrics for around 8’000 companies globally. This corresponds to almost 20% of the companies for which SigmaQ Analytics is already providing corporate default probabilities. We integrated ESG data into our already existing default database that covers more than 20 years of default data. Our ESG data go back till 2015. A recalibration of our model just carried out has added almost a year of additional data.

A new risk factor

The first ESG risk factor that we integrate into our PD model is green-house gas emissions. This factor has the best data quality and produces the strongest signal in the model. We use emissions per $ revenue as metric.

The “ESG signal” is not yet very strong, but a recent recalibration of our ESG PD model showed that it has already become stronger, an effect that will continue as ESG aspects become more integrated into the economy.

The impact

We analyse the impact of the emission risk factor on the probability of default of some of the most affected companies.

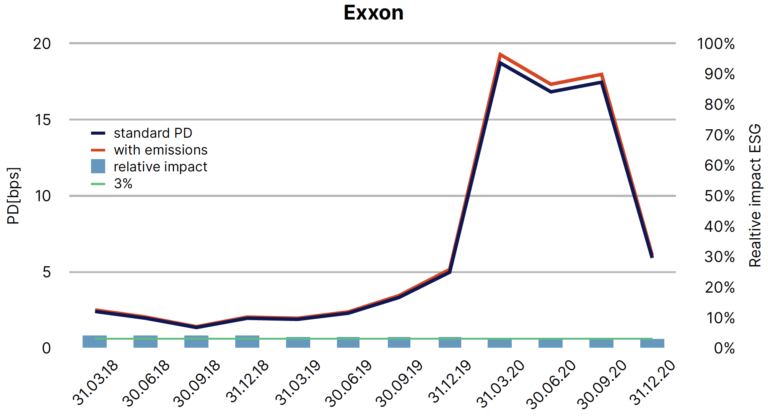

It is well known for example that Exxon is among the companies with highest green-house gas emissions worldwide. But what is the impact of these emissions on Exxon’s PD?

We use emissions per $ of sales as the metric rather than absolute emissions in our model. This significantly reduces the impact in Exxon’s case. As a result, Exxon’s ESG PD is higher than its standard PD, but less pronounced than one might intuitively expect (the impact is around 3%).

In addition, Exxon also has made tremendous effort to reduce its carbon footprint in recent years, which is reflected in a declining impact (see the chart below).

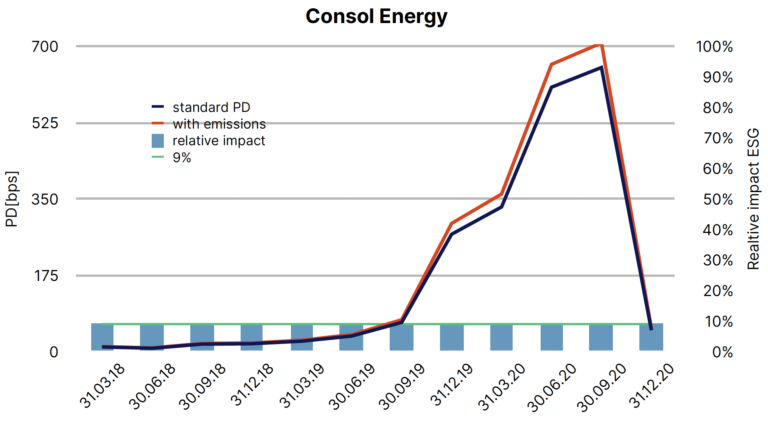

We can compare Exxon’s case with another company from the energy sector, which performs worse in our emission metric. Consol Energy’s emissions are on a relative basis (relative to sales) considerably higher. Thus, the impact on PD is more pronounced with around 9%. Consol Energy’s emissions also do not show any significant decrease over the last 5 years (see chart below). In the case of Consol Energy, the impact of emissions on PD is among the highest in our entire data set.

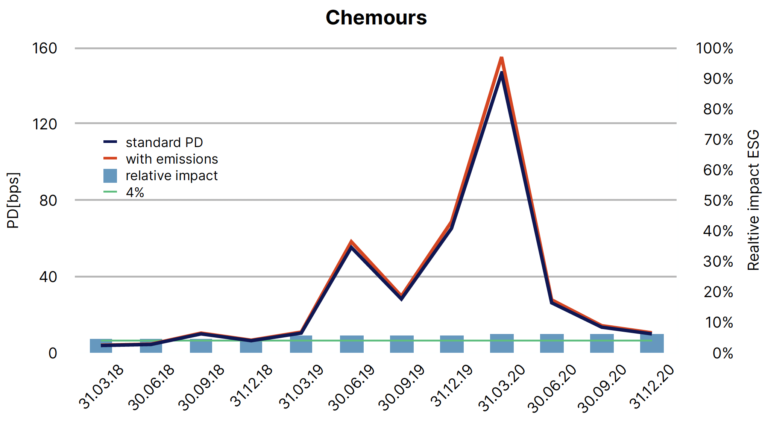

Looking at a company from the chemical sector, here Chemours, we see that it performs similarly than Exxon in terms of our relative emission metric. But unlike Exxon the relative impact even tends to increase over recent years. The relative impact on its PD is about 4%.

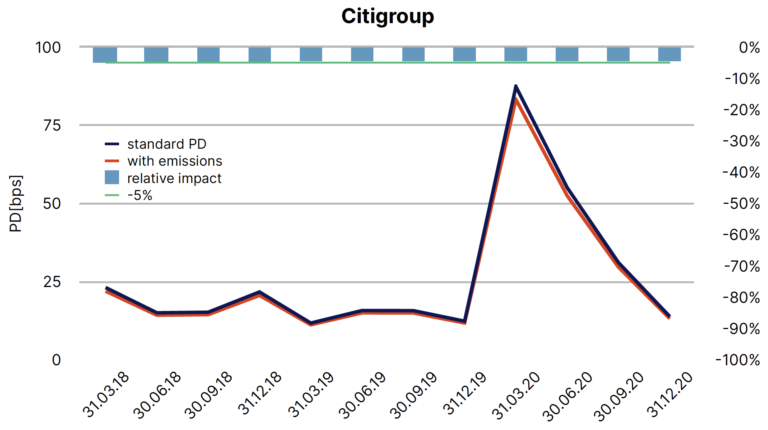

On the other end we have companies with low or very low emissions. Citigroup is an example of such a company. The impact of emissions on its PD is even negative with around 5%.

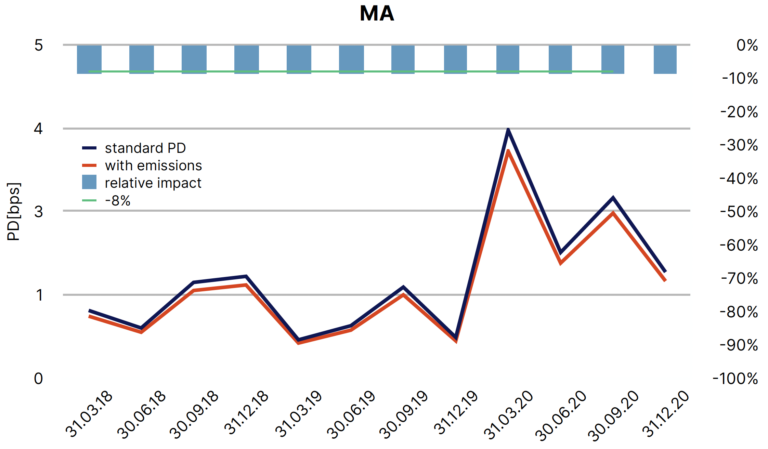

Like Citigroup, Mastercard is an example of a company that performs very well in our relative emission metric.

Also here, this leads to a negative impact which is even higher than for Citigroup with around 8%.

Summary and conclusion

SigmaQ’s ESG PD model is a leading, innovative default prediction technology for assessing credit risk of thousands of companies worldwide with ESG factors integrated. It is a fully calibrated and consistent model, built on objective and transparent input data only.

Over the last 2.5 years SigmaQ Analytics has developed its innovative approach for gauging credit quality of public companies. Its cutting edge default-prediction technology has been designed specifically to handle new risk factors or structural breaks in the economy. Using extensive insights from Data Science, Econometrics, Bayesian statistics and rich data sets we developed an unprecedented methodology to estimate corporate default risk. Our standard PD model covers 35’000 companies, our ESG PD model covers 8’000 companies worldwide.

Contact us for more information: contact@sigmaqanalytics.com