Practical Insights

Fallen Angels - Rising Stars

The COVID-19 crisis has resulted in an unprecedented number of fallen angels, i.e., bond issuers that have been downgraded from investment grade to speculative grade. When the pandemic broke out in February 2020, rating agencies began downgrading a significant number of companies from investment grade to speculative grade, including companies such as Ford, Kraft-Heinz, Lufthansa, and others. The market for “Fallen Angels” more than doubled that year, and more than $200 billion of debt was moved to junk status. Since then, it has declined only slightly.

The economic basis for these downgrades was particular and different from previous crises such as the great financial crisis of 2008/09 or the European debt crisis. In this respect, the recovery so far also appears to be very different. Some hard-hit sectors have recovered relatively quickly, while others are still struggling with the aftermath. But the upgrades of some of the fallen angels that have recovered very well from the crisis shock are not happening as quickly as some of the downgrades that were made in the pandemic.

Using SigmaQ’s corporate default probability model, we analyzed a set of more than 20 fallen angels that we believe are candidates for upgrades to investment grade, making them potential advancers. Here we discuss three such cases. For the presentation with the full list of potential rising stars we identified (as well as more details on our analysis), please write to us at: contact@sigmaqanalytics.com.

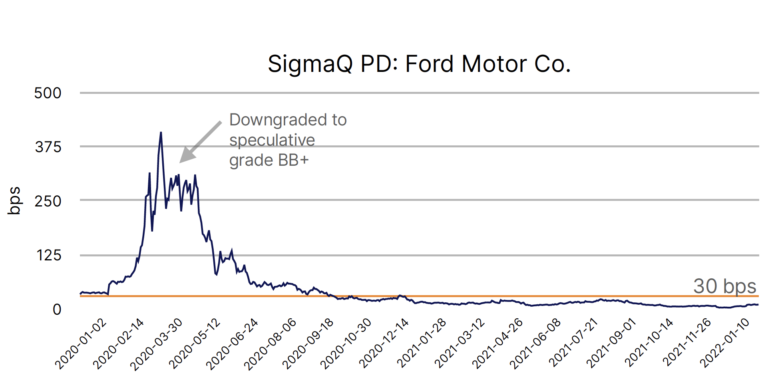

One of the most prominent downgrades at the beginning of the crisis was Ford. The increased credit risk is confirmed by our PD model: Ford’s PD hovered around 2.5% at the height of the crisis. But since the fall of 2020, our model has shown PD values comparable to those before the crisis. And they have not changed significantly since then.

Analysing the main drivers of PD during and after the crisis, Ford’s credit quality recovery is impressive. Ford has improved in almost all credit metrics, especially in profitability through the implementation of cost-cutting programs. We strongly believe that the rating agencies will soon return Ford to an investment grade rating.

Our second rising star is also from the automotive industry. Valeo SA was downgraded by S&P to junk status a bit later in the crisis. Its PDs reached reached high levels during the same time as Ford according to our PD model, i.e. above 2%. But as in the case of Ford, the situation has changed since and stabilised over the last 1.5 years.

Analysing the credit metrics during and after the crisis, the recovery of Valeo’s credit quality seems less pronounced than that of Ford. But it’s credit quality also does not have deteriorated as in the case of Ford. But also Valeo has improved on almost all of its credit metrics, particularly performance and liquidity. We believe Valeo also is a candidate for an upgrade to investment grade.

Our third and last case is Accor, a world leading hotel operator. As with Compared to the two cases from the automotive industry, the downgrade of Accor happened relatively “late” in the crisis, almost half a year later than for Renault and Ford. Our PD model clearly indicates lower peak levels for the PD than for the other two cases, which also came in later during the crisis. The volatility also stayed a little longer, but we clearly observe a stabilisation since more than a year.

For the presentation with the full list of potential rising stars we identified (as well as more details on our analysis), please write to us at: contact@sigmaqanalytics.com.

What are SigmaQ PD?

SigmaQ Analytics uses a novel approach to quantify corporate default risk by using cutting-edge techniques from data science. We deliver more than 35’000 default probabilities for the listed corporate debt market on daily basis. Our model is able to embed new risk factors easily and can handle structural breaks in the economy. Please visit our website www.sigmaqanalytics.com for more details.

How do SigmaQ PDs relate to other PDs available in the market?

There are mainly two approaches available in the market to quantify PDs. One follows a structural approach to credit risk, the other one follows a so-called reduced-form model.

In the structural approach typically a look-up table is used, which links the distance-to-default (DD) to historically observed default rates. The determination of the DD is a complex process with many degrees of freedom and subjective inputs. Among others, the DD needs careful modelling of assets and liabilities, where the non-observable asset process must be inferred from the observable equity price process. The mapping of the DD to historical default rates usually is performed by allocation of companies to sectors into which these default rates are broken down. The mapping process thus needs exogenous information that cannot be found in the model itself.

The so-called reduced from econometric approach essentially typically based a dynamic Logit model. A very similar approach is also used in modelling of PDs under the IRB (internal rating based) Basel regime. This methodology is a sound approach to determine default probabilities. These models typically use firm-specific and market factors as variables to determine default probabilities. There is no subjectivity entering the model.