Analytics & Models

SigmaQ Risk Analytics

We provide a suite of risk models and analytics that deliver on critical business applications like macro-economic scenario analysis, stress testing and credit portfolio modelling.

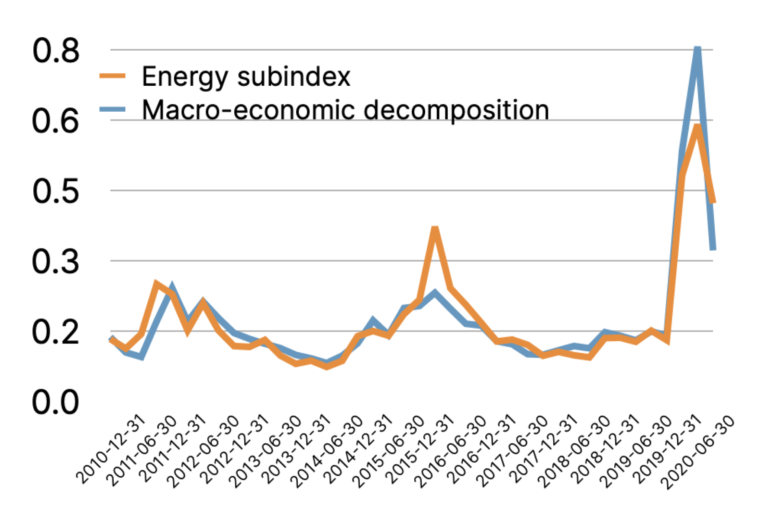

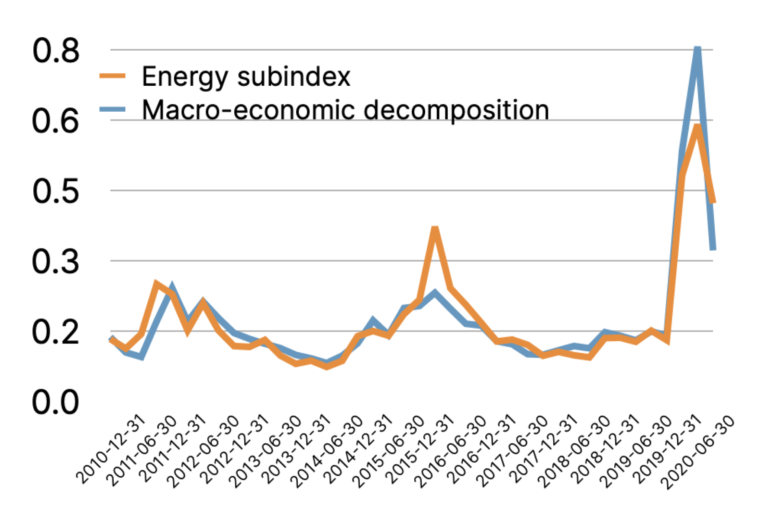

Macro-Economic Modelling

Our macroeconomic modeling suite lets you analyze the macroeconomic factors underlying corporate default risk at the company, sector and also credit index level. We provide credit indices that are based on SigmaQ’s corporate default probabilities and which are used in our IFRS 9/CECL models.

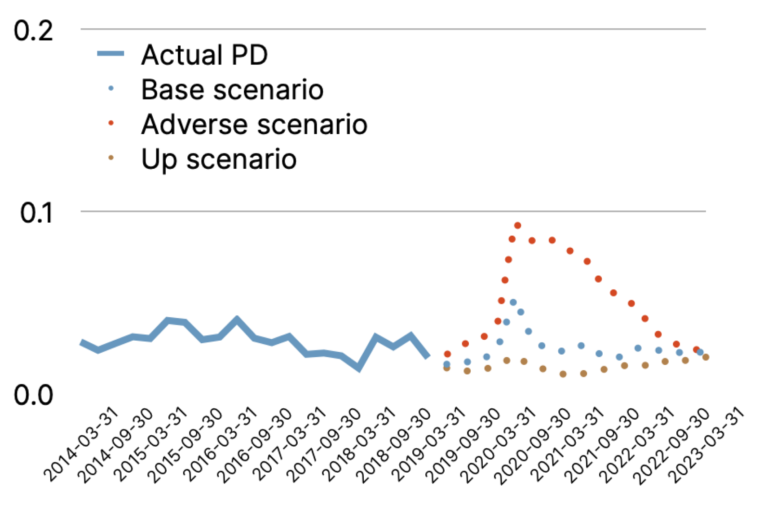

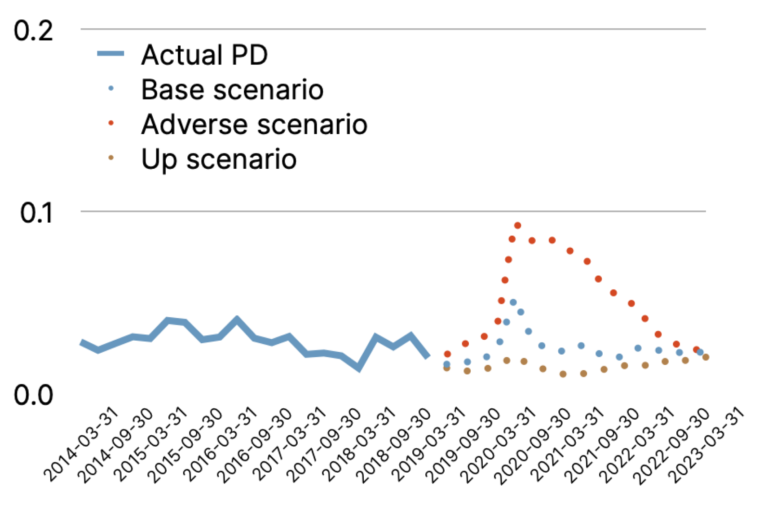

Scenario Analysis and Credit Stress Testing

Credit stress testing and “what-if” scenarios are indispensable analytics that every financial/credit risk management must have in place.

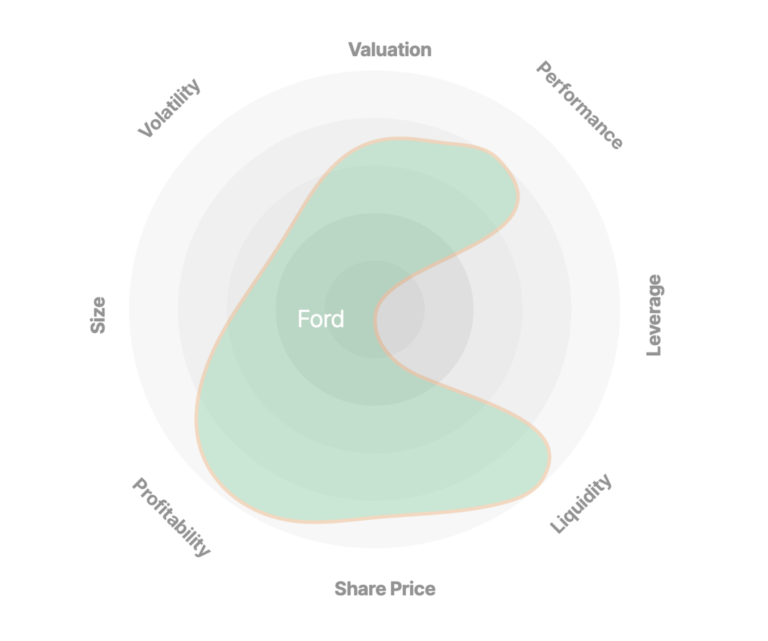

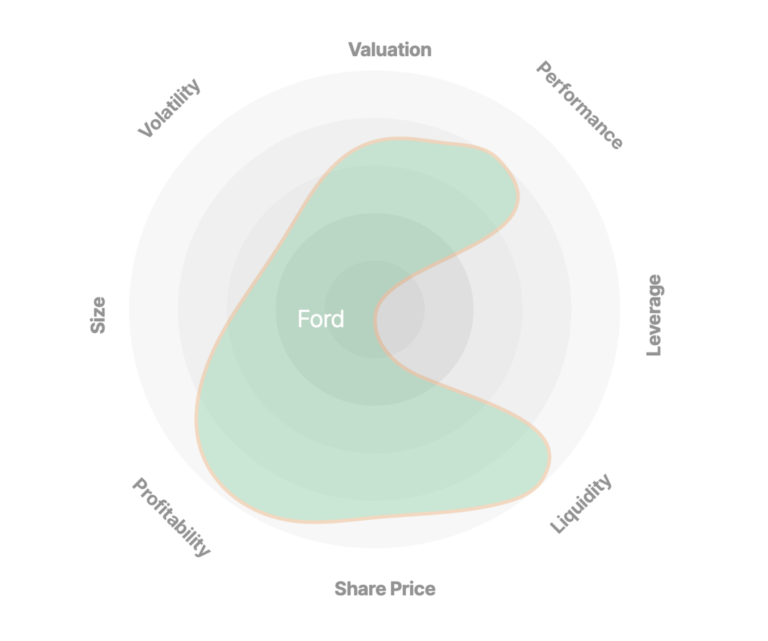

Attribution Analysis

What are the key financial and market factors influencing corporate default risk? Our attribution analysis gives you full transparency on the drivers behind the default probability process.

Credit Portfolio Risk

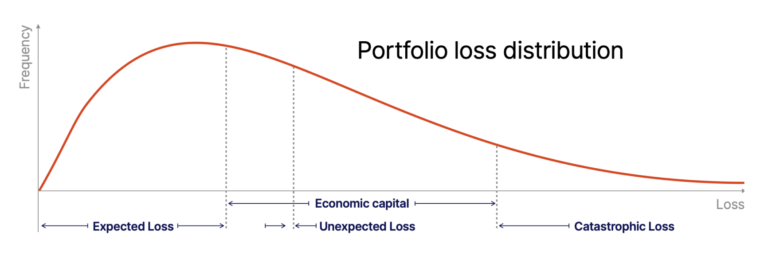

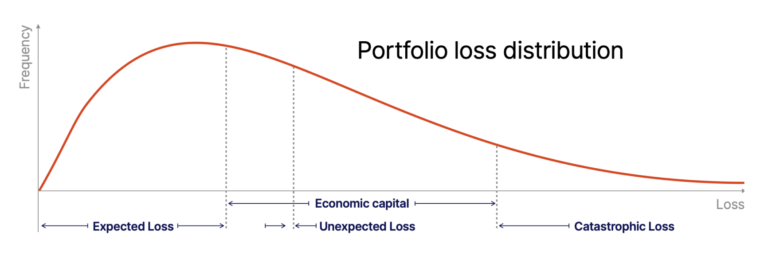

Credit risk needs to be measured and managed not only at transaction level but also on portfolio level. Credit portfolio models (CPMs) are designed to measure credit losses in credit portfolios and determine their asymmetric loss distribution. We have full-fledged object-oriented Python implementations of standard and contingent credit portfolio models in place.