Default Probability

The case of Credit Suisse

When an institution the size of Credit Suisse enters a downward spiral, as is currently underway, one cannot help but be reminded of the events of 2008, where there were also – like today – some early warning signs in the form of collapsing hedge funds.

In this very situation, we were asked by one of our clients how it is possible that their vendor’s model-based default probability for Credit Suisse basically did not move over the last three months, and specially also not in the last few weeks. After all, as an important indicator of a company’s creditworthiness, it should have seen some increase in recent months and weeks.

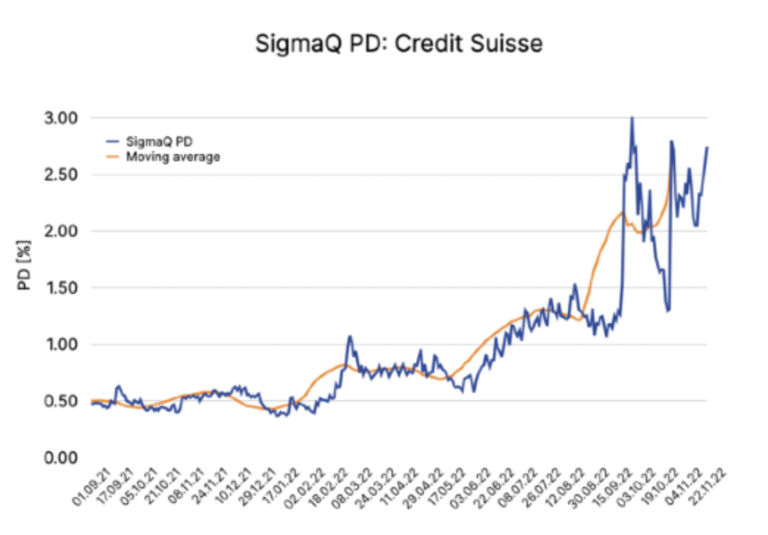

So we looked at the probability of default for Credit Suisse in our own model, which shows clear credit risk early warning signals already in June and a continuous deterioration since then (see figure 1).

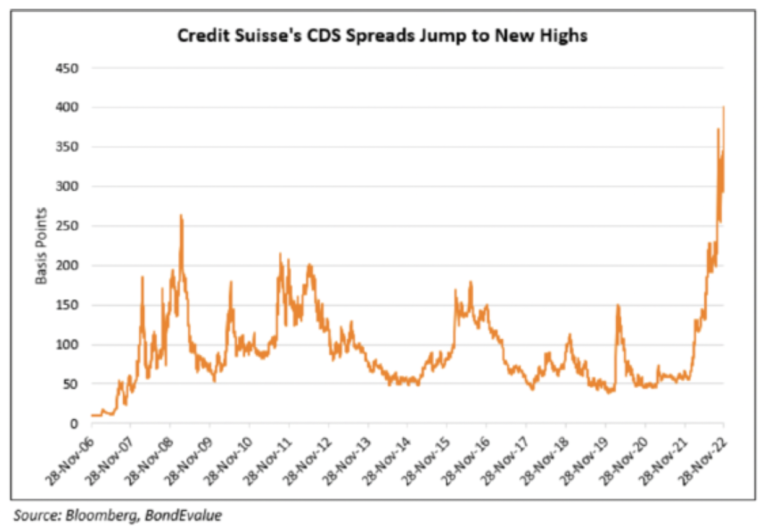

This view is strongly supported by market expectations, expressed through the credit default swap spread: these swaps trade at just over 410 basis points at the moment. This corresponds to a (risk-neutral) probability of default of around 6.9%. The development of the credit default spread has also been dramatic here since June (see figure 2).

Which factors are the important drivers of Credit Suisse’s increasing default probability in SigmaQ’s model? At the moment these are:

• Continuing difficulties to increase profitability (after several quarters with negative income the next one is just ahead)

• Continuing underperformance in the market

• A deteriorating valuation of the company

• An increasing equity volatility

With other parameters like leverage and liquidity still in good shape, it is this vicious circle of declining profits, valuation and falling share price that puts Credit Suisse in a difficult situation despite otherwise healthy financials.

How can it be then that another model does not show any increase in credit risk for Credit Suisse over the last months? Quite often structural credit risk (Merton-type) models are used in the industry (like Moody’s KMV). Such models try to measure the default probability of firms by predicting unobservable quantities like asset prices and asset volatilities. There is less space in these models for reflecting observable quantities like profitability, performance, valuation or share price of the firm. But neglecting such quantities in assessing the credit risk of a firm can lead to situations where early (and also later) warning signals are simply not picked up. What does your vendor’s PD model say for the case of Credit Suisse?

How does the default probability of Credit Suisse compare to some of its peers in our model? A comparative analysis (see figure 3) shows Credit Suisse’s unfavourable situation among its peers.

SigmaQ’s novel credit risk technology only uses observable quantities like profitability, leverage, liquidity, performance, volatility, price, etc. to predict the default probability of firms based on a fully calibrated model. Our default database covers more than 2’000 corporate defaults in the developed markets. With more than 70 exchanges integrated SigmaQ’s model covers around 40’000 corporates worldwide. We deliver our data via APIs through a cutting-edge Fintech infrastructure using Kubernetes, Prefect, PostgreSQL databases and an Azure cloud. Our credit risk data are used in renowned financial institutions since 2020.