Rely on smarter data.

Credit risk data derived through

next generation analytics.

Credit risk data based on SigmaQ’s novel

default risk technology

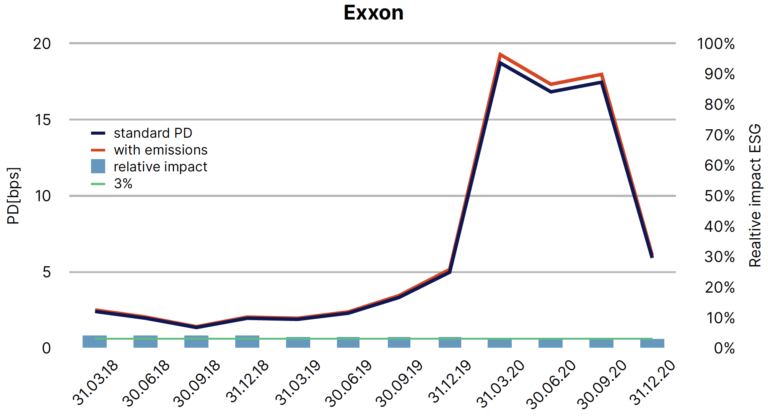

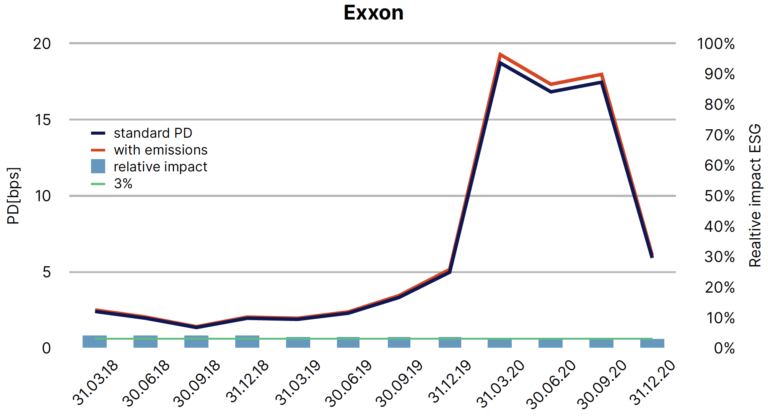

SigmaQ's novel credit risk technology brings innovations to the measurement of corporate default risk that offer various desirable advantages over more traditional approaches. As one of the first providers worldwide we were able to successfully integrate greenhouse gas emissions into the measurement of corporate default risk in a fully calibrated model.

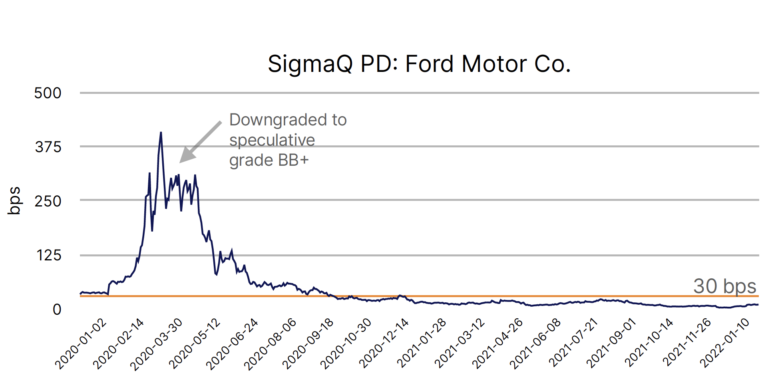

SigmaQ Default Risk Metric

Our default risk technology is built on latest data science approaches and makes use of Bayesian updating. The calibration itself builds on SigmaQ’s corporate default database and an overall default history of more than 50 years. We currently provide corporate default probabilities for 35’000+ companies globally for 70+ market places.

SigmaQ Emission-Adjusted Default Risk Metric

Our credit risk technology enables us us to integrate new risk factors into the estimation sample. We were one of the first providers worldwide to successfully integrate greenhouse gas emissions into the measurement of corporate default risk. We provide emission-adjusted corporate default probabilities for 8’000+ companies globally.

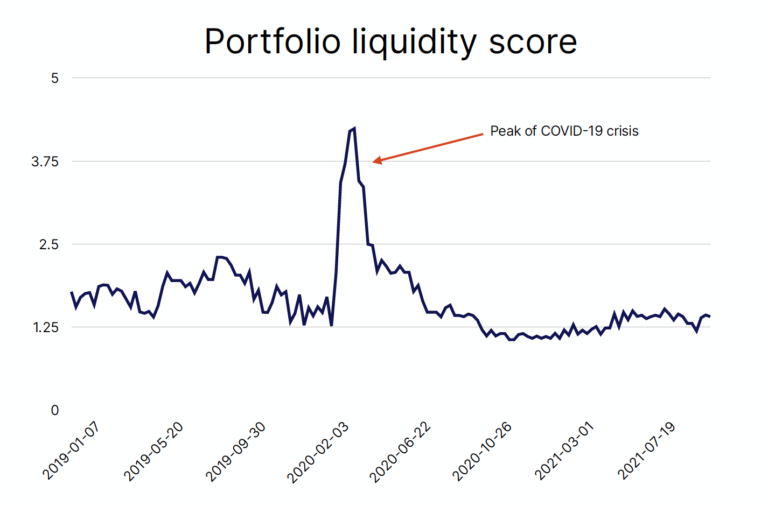

SigmaQ Liquidity Risk Metric

SigmaQ Analytics provides a liquidity risk indicator for sovereign and corporate bonds on ISIN level, covering the entire global, developed market with 250’000+ bonds. We provide composite liquidity risk metrics for investment portfolios.